Source : https://www.bloomberg.com

A Russian Software Billionaire Takes on SAP and Oracle

Boris Nuraliev has built a fortune with enterprise software tailored to Russian needs.

By

and

Nuraliev, 58, got started in technology during the Soviet era as a computer engineer in the State Statistics Committee. In 1991 he founded 1C to sell business programs such as the Lotus 1-2-3 spreadsheet and networking software to link computers in the pre-internet age. He soon added his own accounting applications, though he struggled to close big deals. “Large firms felt ashamed of using 1C,” Nuraliev says. But his software was flexible and cheap, a big draw for the thousands of small and midsize companies that sprang up after the fall of communism.

A big advantage for 1C has been that it rapidly adapts its products to ever-changing Russian accounting rules, says Olga Uskova, president of Cognitive Technologies, a Moscow company that makes software for autonomous vehicles. She says Nuraliev has a deep understanding of everyday accountants and has won their loyalty with seminars on using his applications to stay on the right side of the law. “Accountants begged their bosses to install 1C,” Uskova says. “You can’t dream of a better sales force.”

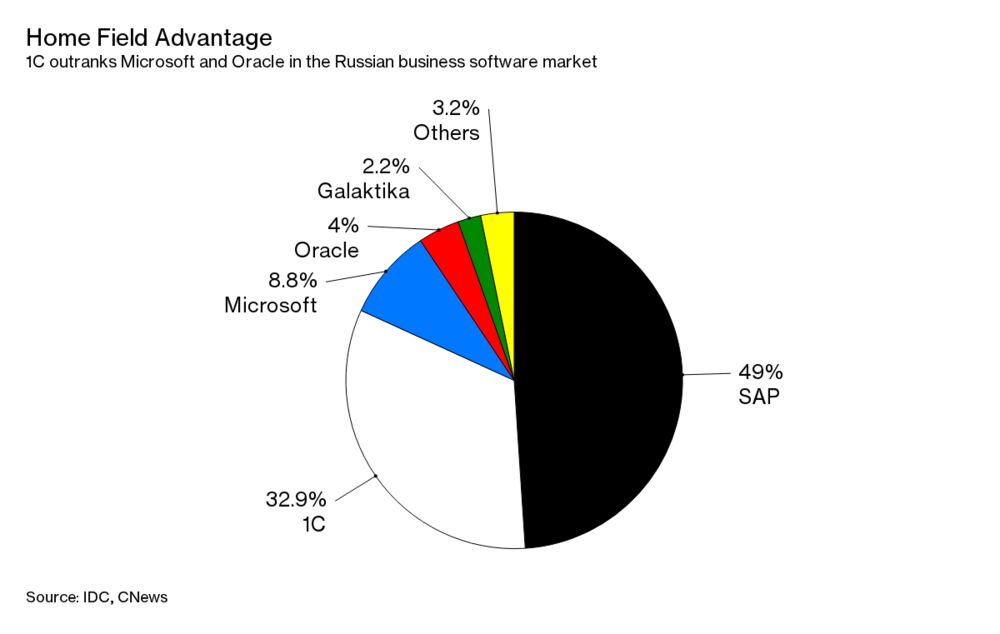

The company’s annual revenue increased 6 percent, to 37 billion rubles ($650 million) last year, giving 1C a third of the Russian market for enterprise applications software, second only to SAP’s 49 percent, according to researcher IDC. Measured by installations, 1C is the leader, with about 5 million users—most from small and midsize businesses that aren’t fully tracked by IDC. Based on comparisons with SAP and three other publicly traded peers, the Bloomberg Billionaires Index values the company at $2.3 billion, meaning Nuraliev—who owns more than half of 1C—has a net worth of $1.2 billion.

Boris Nuraliev

Photographer: Andrey Rudakov/Bloomberg

Andrey Krivenko, founder of a 460-store grocery chain called VkusVill, hired a 1C franchisee to automate his operation. The consultant uses 1C’s software to track goods Krivenko’s workers register with hand-held scanners, smartphones, and image-recognition applications. All told, he says the 1C programs cost less than 10 percent of what he would have paid one of the global giants for a similar installation. When the business was started in 2009, “we just couldn’t afford SAP or Oracle,” Krivenko says. Although he could do so now, he says he’s sticking with 1C.

Nuraliev has made a few sales abroad as franchisees have picked up local clients in Germany, the U.S., and China. In May he formed a division to target international business, though concerns about Russian hacking could make that a hard sell, and Ukraine, for instance, has restricted 1C’s operations. IDC analyst Elena Semenovskaia also cautions that it may be tough for 1C “to build a partner network as strong as they’ve got in Russia.” Nuraliev acknowledges that it won’t be easy taking on the global giants outside of Russia, but he says 1C’s expertise with smaller companies in a frontier economy could make it a winner in many parts of the developing world, noting that he’s already won contracts in Vietnam. “In emerging markets like Russia, we have a competitive advantage,” he says. “Firms here need to adapt to market changes quickly.”

Comments

Post a Comment